Textile Electrospinning Nanofiber Manufacturing in 2025: Unraveling the Next Wave of High-Performance Fabrics. Explore How Cutting-Edge Nanofiber Technologies Are Transforming the Textile Industry and Fueling Double-Digit Growth.

- Executive Summary: Key Findings and 2025 Outlook

- Market Size and Growth Forecast (2025–2030): 18% CAGR and Revenue Projections

- Technology Landscape: Innovations in Electrospinning for Nanofiber Production

- Competitive Analysis: Leading Players and Emerging Startups

- Application Deep Dive: Textiles, Filtration, Medical, and Beyond

- Supply Chain and Manufacturing Trends

- Regulatory Environment and Standards

- Investment, M&A, and Funding Activity

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges and Barriers to Adoption

- Future Outlook: Disruptive Opportunities and Strategic Recommendations

- Sources & References

Executive Summary: Key Findings and 2025 Outlook

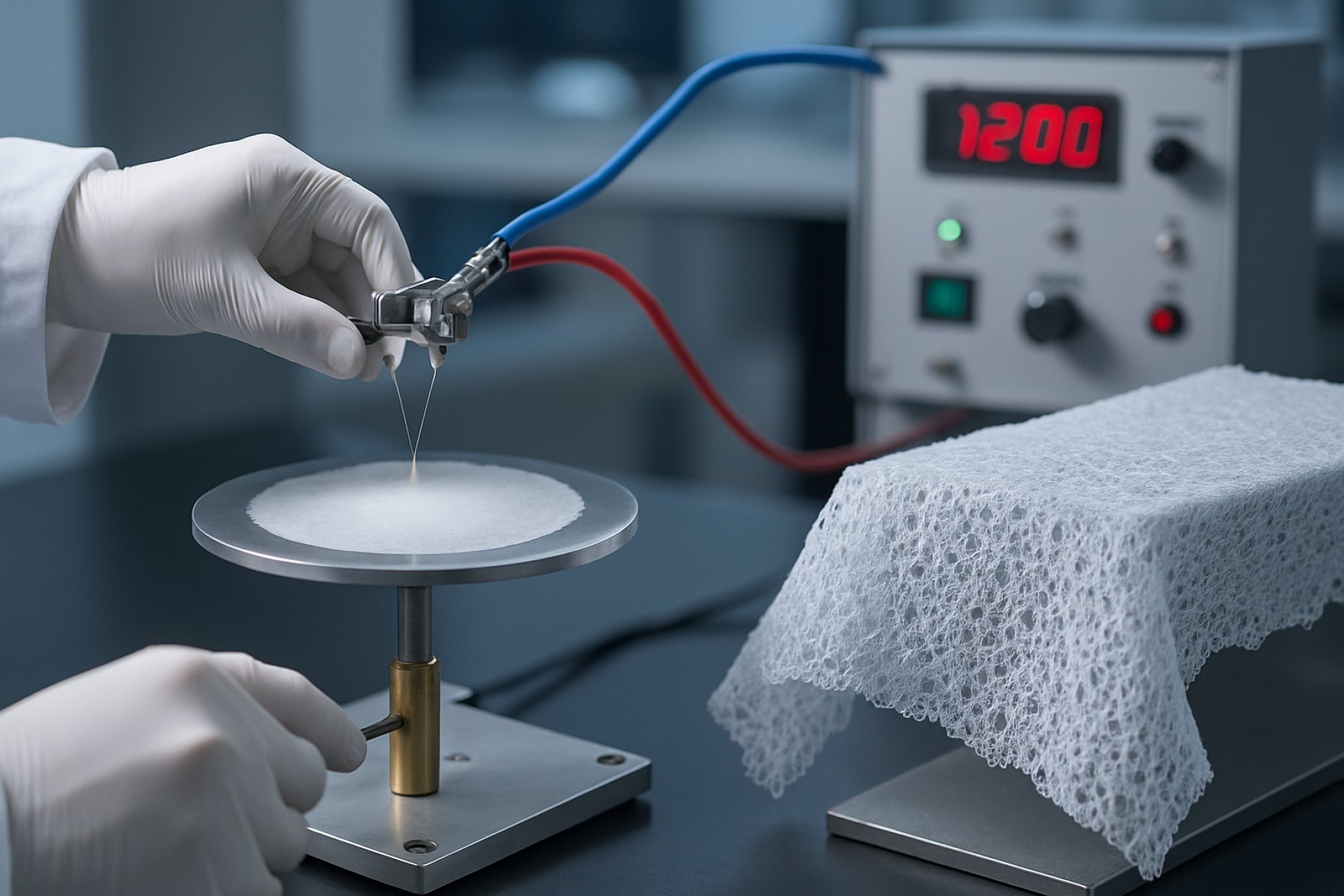

The textile electrospinning nanofiber manufacturing sector is poised for significant growth and innovation in 2025, driven by advancements in process scalability, material diversity, and end-use applications. Electrospinning, a technique that produces ultrafine fibers from polymer solutions or melts using high-voltage electric fields, has transitioned from laboratory-scale research to industrial-scale production, enabling the creation of nanofibers with diameters ranging from tens to hundreds of nanometers. These nanofibers offer unique properties such as high surface area-to-volume ratios, tunable porosity, and enhanced mechanical performance, making them highly attractive for applications in filtration, medical textiles, protective clothing, and smart textiles.

Key findings for 2025 indicate that leading manufacturers are investing in automated, high-throughput electrospinning systems to meet rising demand for nanofiber-based products. Companies such as Freudenberg Group and Auburn Manufacturing, Inc. are expanding their nanofiber production capabilities, focusing on both synthetic and bio-based polymers to address sustainability concerns. The integration of advanced monitoring and quality control technologies is improving product consistency and reducing production costs, further accelerating market adoption.

The medical and filtration sectors remain the primary drivers of market growth, with nanofiber membranes being increasingly adopted for wound dressings, drug delivery systems, and high-efficiency air and liquid filtration. Regulatory approvals and collaborations with healthcare organizations, such as Baxter International Inc., are facilitating the commercialization of medical-grade nanofiber products. In parallel, the development of functionalized nanofibers—incorporating antimicrobial, conductive, or responsive properties—is opening new opportunities in smart textiles and wearable electronics.

Looking ahead to 2025, the outlook for textile electrospinning nanofiber manufacturing is robust. Industry stakeholders anticipate continued investment in research and development, particularly in the areas of green chemistry, biodegradable polymers, and process digitalization. Strategic partnerships between manufacturers, research institutes, and end-users are expected to accelerate innovation and market penetration. As regulatory frameworks evolve and consumer awareness of nanofiber-enabled products grows, the sector is well-positioned for sustained expansion and technological advancement.

Market Size and Growth Forecast (2025–2030): 18% CAGR and Revenue Projections

The textile electrospinning nanofiber manufacturing sector is poised for robust expansion between 2025 and 2030, with industry analysts projecting a compound annual growth rate (CAGR) of approximately 18%. This surge is driven by escalating demand for advanced materials in filtration, medical textiles, protective clothing, and energy storage applications. The unique properties of electrospun nanofibers—such as high surface area-to-volume ratio, tunable porosity, and superior mechanical strength—are catalyzing their adoption across diverse industries.

Revenue projections for the global textile electrospinning nanofiber market indicate a significant leap, with estimates suggesting the market could surpass several billion USD by 2030. This growth trajectory is underpinned by ongoing investments in research and development, as well as the scaling up of production capacities by leading manufacturers. Companies such as Freudenberg Group and Auburn Manufacturing, Inc. are at the forefront, leveraging advanced electrospinning technologies to meet the rising demand for high-performance nanofiber textiles.

The Asia-Pacific region is expected to dominate market share, fueled by rapid industrialization, expanding healthcare infrastructure, and government initiatives supporting nanotechnology research. Meanwhile, North America and Europe are witnessing increased adoption in the automotive, aerospace, and personal protective equipment sectors, further contributing to overall market growth. Strategic collaborations between research institutions and industry players, such as those facilitated by the American Association of Textile Chemists and Colorists (AATCC), are accelerating the commercialization of innovative nanofiber products.

Key growth drivers include the rising emphasis on sustainability, as electrospinning enables the use of biodegradable and recycled polymers, and the ongoing development of scalable, cost-effective manufacturing processes. As regulatory standards for filtration efficiency and safety become more stringent, the demand for nanofiber-based solutions is expected to intensify, reinforcing the sector’s positive outlook through 2030.

Technology Landscape: Innovations in Electrospinning for Nanofiber Production

The technology landscape for textile electrospinning nanofiber manufacturing is rapidly evolving, driven by the demand for advanced materials with superior properties such as high surface area, tunable porosity, and enhanced mechanical strength. Electrospinning, a process that uses an electric field to draw charged threads of polymer solutions or melts into fibers with diameters ranging from nanometers to micrometers, has become a cornerstone in the production of nanofibers for textiles. Recent innovations are focused on scaling up production, improving fiber uniformity, and enabling the use of a broader range of polymers, including biodegradable and functionalized materials.

One significant advancement is the development of multi-jet and needleless electrospinning systems, which address the limitations of traditional single-needle setups by increasing throughput and enabling continuous, large-scale nanofiber production. Companies such as Elmarco s.r.o. have pioneered industrial-scale needleless electrospinning machines, allowing for the efficient manufacture of nanofiber webs suitable for filtration, medical, and apparel applications.

Automation and process control technologies are also being integrated to ensure consistent fiber morphology and quality. Real-time monitoring systems, including in-line imaging and feedback loops, are now standard in advanced electrospinning equipment, as seen in the offerings from Fraunhofer Society and SPINTEC Solutions. These systems enable precise control over parameters such as voltage, flow rate, and environmental conditions, which are critical for reproducibility and scalability.

Material innovation is another key area, with research institutions and manufacturers exploring new polymer blends, composites, and functional additives to impart properties like antimicrobial activity, UV protection, and enhanced breathability. For example, Freudenberg Group has developed nanofiber-based nonwovens with tailored functionalities for technical textiles and personal protective equipment.

Looking ahead to 2025, the integration of green chemistry principles and sustainable feedstocks is expected to further transform the field. Biodegradable polymers and solvent-free electrospinning processes are gaining traction, aligning with the textile industry’s push toward circularity and reduced environmental impact. As these innovations mature, electrospun nanofibers are poised to play a pivotal role in next-generation textile products, from smart wearables to high-performance filtration media.

Competitive Analysis: Leading Players and Emerging Startups

The textile electrospinning nanofiber manufacturing sector is characterized by a dynamic mix of established industry leaders and innovative startups, each contributing to the rapid evolution of nanofiber applications in textiles, filtration, medical, and energy sectors. As of 2025, the competitive landscape is shaped by advancements in scalable production, material diversity, and integration with smart textile technologies.

Among the leading players, Freudenberg Group stands out for its extensive portfolio of nonwoven and nanofiber-based products, leveraging decades of expertise in filtration and technical textiles. Auburn Manufacturing, Inc. and Elmarco s.r.o. are also prominent, with Elmarco recognized for its industrial-scale electrospinning equipment and turnkey solutions, enabling mass production of nanofiber webs for diverse applications.

In the medical and healthcare domain, Cornell University and its spin-offs have pioneered electrospun nanofiber scaffolds for tissue engineering and wound care, often collaborating with industry partners to commercialize novel materials. Nanofiber Labs and FibeRio Technology Corporation have also made significant strides, focusing on high-throughput production and functionalization of nanofibers for advanced filtration and protective apparel.

Emerging startups are driving innovation by addressing key challenges such as cost-effective scale-up, eco-friendly polymers, and integration with wearable electronics. Spin Technologies and Novatex Nano are notable for their proprietary electrospinning platforms that enable precise control over fiber morphology and composite structures. These startups often collaborate with academic institutions and textile manufacturers to accelerate commercialization and expand application areas.

The competitive environment is further influenced by strategic partnerships, intellectual property development, and government-backed research initiatives. Companies are increasingly focusing on sustainability, with several players developing biodegradable nanofibers and green manufacturing processes to meet regulatory and consumer demands. As the market matures, the interplay between established manufacturers and agile startups is expected to drive both incremental improvements and disruptive breakthroughs in textile electrospinning nanofiber manufacturing.

Application Deep Dive: Textiles, Filtration, Medical, and Beyond

Electrospinning has emerged as a transformative technology in the manufacturing of nanofibers, enabling the production of materials with unique properties for a wide range of applications. In the textile sector, electrospun nanofibers are increasingly used to create advanced fabrics with enhanced breathability, moisture management, and mechanical strength. These properties are particularly valuable in performance apparel, protective clothing, and smart textiles, where lightweight and functional materials are in high demand. Companies such as Freudenberg Performance Materials are actively developing nanofiber-based textiles for both consumer and industrial markets.

Filtration is another domain where electrospun nanofibers have made significant inroads. The high surface area-to-volume ratio and tunable pore sizes of nanofiber mats make them ideal for capturing fine particulates, bacteria, and viruses. This has led to their adoption in air and liquid filtration systems, including HVAC filters, water purification membranes, and personal protective equipment. For instance, AER Filter utilizes electrospun nanofibers to enhance the efficiency and longevity of their filtration products.

In the medical field, electrospun nanofibers are being explored for a variety of applications, including wound dressings, tissue engineering scaffolds, and drug delivery systems. Their biocompatibility and ability to mimic the extracellular matrix make them suitable for supporting cell growth and tissue regeneration. Companies like Nanofiberlabs are at the forefront of developing medical-grade nanofiber materials, focusing on both research and commercial-scale production.

Beyond these established sectors, electrospun nanofibers are finding new applications in energy storage, sensors, and environmental remediation. For example, nanofiber-based separators are being developed for lithium-ion batteries to improve safety and performance, while functionalized nanofibers are used in sensors for detecting chemical and biological agents. The versatility of electrospinning technology allows for the incorporation of various polymers, ceramics, and even bioactive compounds, broadening the scope of potential applications.

As research and industrial capabilities continue to advance, the integration of electrospun nanofibers into diverse products is expected to accelerate, driving innovation across multiple sectors and addressing emerging challenges in health, sustainability, and technology.

Supply Chain and Manufacturing Trends

The textile industry is witnessing significant advancements in electrospinning nanofiber manufacturing, with 2025 poised to be a pivotal year for supply chain and production trends. Electrospinning, a process that creates ultra-fine fibers from polymer solutions using electric force, is increasingly adopted for its ability to produce nanofibers with unique properties such as high surface area, porosity, and tunable functionality. These characteristics are driving demand in sectors ranging from filtration and medical textiles to smart fabrics and energy storage.

A key trend in 2025 is the scaling up of electrospinning processes from laboratory to industrial production. Companies like Freudenberg Group and Auburn Manufacturing, Inc. are investing in automated, high-throughput electrospinning lines to meet growing market needs. These systems integrate real-time quality monitoring and advanced robotics, reducing labor costs and ensuring consistent nanofiber quality. Additionally, modular manufacturing units are being deployed, allowing for flexible production that can be quickly adapted to changing product specifications or market demands.

Supply chain resilience is another focal point. The COVID-19 pandemic exposed vulnerabilities in global textile supply chains, prompting manufacturers to localize or regionalize production. In 2025, more companies are establishing partnerships with local suppliers of polymers and additives, as well as investing in vertical integration to secure critical raw materials. Organizations such as INDA, Association of the Nonwoven Fabrics Industry are facilitating collaboration and standardization efforts to streamline procurement and logistics.

Sustainability is also shaping supply chain decisions. There is a marked shift toward bio-based and recycled polymers for nanofiber production, with manufacturers like Lenzing AG pioneering the use of cellulose and other renewable feedstocks. This not only reduces environmental impact but also appeals to eco-conscious consumers and regulatory bodies. Furthermore, closed-loop manufacturing systems are being implemented to minimize waste and recover solvents, aligning with circular economy principles.

In summary, the textile electrospinning nanofiber sector in 2025 is characterized by industrial-scale automation, supply chain localization, and a strong emphasis on sustainability. These trends are collectively enhancing the efficiency, resilience, and environmental responsibility of nanofiber manufacturing, positioning the industry for continued growth and innovation.

Regulatory Environment and Standards

The regulatory environment for textile electrospinning nanofiber manufacturing is evolving rapidly as the technology matures and its applications expand across sectors such as medical textiles, filtration, and smart fabrics. In 2025, manufacturers must navigate a complex landscape of standards and compliance requirements that address both the unique properties of nanofibers and the broader textile industry regulations.

Key international standards organizations, such as the International Organization for Standardization (ISO) and the ASTM International, have developed and continue to update standards relevant to nanofiber characterization, safety, and performance. For instance, ISO/TS 80004-2:2015 provides terminology for nanomaterials, while ASTM E2456-06 outlines standard terminology relating to nanotechnology. These standards help ensure consistency in the measurement of fiber diameter, porosity, and mechanical properties, which are critical for product quality and regulatory approval.

In the European Union, the European Commission enforces the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation, which applies to nanomaterials used in textile manufacturing. Manufacturers must provide detailed safety data and risk assessments for nanofiber products, particularly if they are intended for skin contact or medical use. The European Chemicals Agency (ECHA) offers guidance on nanomaterial registration and compliance under REACH.

In the United States, the U.S. Environmental Protection Agency (EPA) and the U.S. Food and Drug Administration (FDA) regulate nanofiber products depending on their end use. For example, nanofiber-based medical devices must comply with FDA’s 21 CFR Part 820 (Quality System Regulation), while filtration products may fall under EPA oversight. The American National Standards Institute (ANSI) also collaborates with industry stakeholders to develop consensus standards for nanotechnology applications.

Manufacturers are increasingly required to implement robust quality management systems, such as those outlined in ISO 9001, and to conduct lifecycle assessments to address environmental and occupational health concerns. As the field advances, ongoing collaboration between industry, regulatory bodies, and standards organizations will be essential to ensure safe, high-quality, and innovative nanofiber textile products.

Investment, M&A, and Funding Activity

The textile electrospinning nanofiber manufacturing sector has witnessed a notable surge in investment, mergers and acquisitions (M&A), and funding activity as of 2025. This growth is driven by the expanding applications of nanofibers in filtration, medical textiles, energy storage, and smart fabrics, prompting both established textile manufacturers and technology startups to seek capital and strategic partnerships.

Major industry players such as Freudenberg Group and Ahlstrom have continued to invest in expanding their nanofiber production capabilities, often through the acquisition of innovative startups specializing in electrospinning technology. These acquisitions are aimed at integrating advanced nanofiber solutions into existing product lines, enhancing performance characteristics such as breathability, filtration efficiency, and mechanical strength.

Venture capital and private equity firms have also shown increased interest in the sector, particularly in companies developing scalable and cost-effective electrospinning platforms. For example, Nanofiber Labs and Revolution Fibres have secured multi-million dollar funding rounds to accelerate commercialization and expand manufacturing capacity. These investments are often accompanied by strategic collaborations with research institutions and end-users in the healthcare and environmental sectors.

Government-backed initiatives and public funding programs in regions such as the European Union and East Asia have further bolstered the industry. Organizations like EIT Manufacturing have provided grants and innovation support to foster the development of sustainable nanofiber production processes, with a focus on reducing environmental impact and promoting circular economy principles.

The competitive landscape is also being shaped by cross-border M&A activity, as global players seek to access new markets and proprietary technologies. For instance, Asian manufacturers have acquired stakes in European nanofiber firms to leverage advanced R&D and tap into high-value applications in automotive and protective textiles.

Overall, the influx of capital and strategic partnerships in 2025 is accelerating the scale-up of textile electrospinning nanofiber manufacturing, driving innovation and positioning the sector for robust growth in the coming years.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global textile electrospinning nanofiber manufacturing market demonstrates distinct regional dynamics, shaped by technological advancement, industrial infrastructure, and end-user demand. In North America, the United States leads with robust R&D investments and a strong presence of academic and commercial entities. The region benefits from collaborations between universities and industry, fostering innovation in nanofiber applications for filtration, medical textiles, and smart fabrics. Companies such as Hollingsworth & Vose and Elmarco (with a significant U.S. presence) are notable players, leveraging advanced electrospinning platforms and scaling up production capabilities.

In Europe, the market is characterized by a focus on sustainability and regulatory compliance, particularly in medical and environmental applications. Countries like Germany, the UK, and the Netherlands are at the forefront, supported by strong government initiatives and funding for nanotechnology. Organizations such as Freudenberg Group and ITO GmbH drive innovation, with a particular emphasis on biodegradable and functionalized nanofibers for automotive, filtration, and healthcare sectors.

The Asia-Pacific region is experiencing the fastest growth, propelled by expanding manufacturing bases, rising demand for high-performance textiles, and increasing investments in research. China, Japan, and South Korea are key contributors, with companies like Toray Industries, Inc. and Mitsubishi Chemical Group Corporation integrating electrospun nanofibers into mainstream textile production. The region’s cost-effective manufacturing and rapid adoption of new technologies position it as a global hub for both large-scale production and innovation.

The Rest of the World segment, including Latin America, the Middle East, and Africa, is at a nascent stage but shows potential due to growing awareness of nanofiber benefits in filtration, protective clothing, and medical applications. Initiatives by organizations such as Council for Scientific and Industrial Research (CSIR) in South Africa are fostering local research and pilot-scale manufacturing, aiming to address regional needs and build capacity for future growth.

Challenges and Barriers to Adoption

The adoption of electrospinning nanofiber manufacturing in the textile industry faces several significant challenges and barriers, despite its promise for producing advanced materials with unique properties. One of the primary obstacles is scalability. Traditional electrospinning setups are often limited to laboratory or pilot-scale production, making it difficult to achieve the high throughput required for commercial textile manufacturing. Efforts to scale up, such as multi-needle or needleless systems, introduce complexities in maintaining uniform fiber morphology and consistent product quality across large areas.

Another challenge is the cost and availability of suitable polymers. Many high-performance nanofibers require specialty polymers that can be expensive or difficult to process. Additionally, solvent selection is critical, as many effective solvents for electrospinning are toxic or environmentally hazardous, raising concerns about worker safety and environmental compliance. The need for solvent recovery systems and safe handling protocols further increases operational costs and complexity.

Integration with existing textile manufacturing processes also presents a barrier. Electrospun nanofibers often require post-processing steps, such as alignment, layering, or bonding to substrates, to be compatible with conventional weaving, knitting, or nonwoven technologies. This integration can necessitate significant capital investment and process redesign, which may deter established manufacturers from adopting the technology.

Quality control and standardization remain unresolved issues. The properties of electrospun nanofibers are highly sensitive to process parameters, environmental conditions, and material inconsistencies. Achieving reproducibility at scale is challenging, and there is a lack of universally accepted standards for nanofiber textiles, complicating certification and market acceptance. Organizations such as the International Organization for Standardization are working towards relevant standards, but widespread adoption is still pending.

Finally, regulatory and market acceptance barriers persist. The introduction of nanomaterials into consumer textiles raises questions about long-term safety, environmental impact, and recyclability. Regulatory frameworks are still evolving, and manufacturers must navigate a complex landscape of compliance requirements. Consumer awareness and acceptance of nanofiber-based textiles are also in early stages, requiring education and transparent communication from industry leaders such as DuPont and Toray Industries, Inc. to build trust and demand.

Future Outlook: Disruptive Opportunities and Strategic Recommendations

The future of textile electrospinning nanofiber manufacturing is poised for significant transformation, driven by advances in materials science, automation, and sustainability imperatives. As the demand for high-performance textiles grows across sectors such as healthcare, filtration, energy, and apparel, electrospinning is emerging as a disruptive technology capable of producing nanofibers with unique properties—such as high surface area, tunable porosity, and enhanced mechanical strength.

One of the most promising opportunities lies in the integration of smart and functional materials into nanofiber textiles. Innovations in incorporating conductive polymers, bioactive agents, and phase-change materials are enabling the development of next-generation products, including wearable sensors, antimicrobial fabrics, and energy-harvesting textiles. Companies like Freudenberg Group and Auburn Manufacturing, Inc. are actively exploring these frontiers, investing in R&D to expand the application scope of electrospun nanofibers.

Automation and scalability remain critical challenges and opportunities. The transition from laboratory-scale to industrial-scale production is being accelerated by advancements in multi-jet and needleless electrospinning systems, as well as real-time process monitoring. Organizations such as Elmarco s.r.o. are pioneering scalable electrospinning equipment, making it feasible to meet commercial demands while maintaining fiber quality and consistency.

Sustainability is another key driver shaping the future landscape. The adoption of bio-based and biodegradable polymers, coupled with solvent recovery and recycling systems, is aligning nanofiber manufacturing with circular economy principles. Industry leaders are collaborating with research institutions to develop greener processes and materials, as seen in initiatives supported by the Advanced Textiles Association.

Strategic recommendations for stakeholders include investing in cross-disciplinary R&D to accelerate the functionalization of nanofibers, forming partnerships with end-users to co-develop application-specific solutions, and prioritizing sustainable manufacturing practices. Additionally, companies should monitor regulatory developments and standardization efforts, as these will influence market access and product certification in the coming years.

In summary, the textile electrospinning nanofiber sector is on the cusp of disruptive growth, with opportunities centered on advanced functionalities, scalable production, and sustainability. Proactive innovation and strategic collaboration will be essential for capturing value in this evolving market.

Sources & References

- Freudenberg Group

- Auburn Manufacturing, Inc.

- Baxter International Inc.

- American Association of Textile Chemists and Colorists (AATCC)

- Elmarco s.r.o.

- Fraunhofer Society

- Cornell University

- Nanofiber Labs

- Freudenberg Performance Materials

- INDA, Association of the Nonwoven Fabrics Industry

- Lenzing AG

- International Organization for Standardization (ISO)

- ASTM International

- European Commission

- European Chemicals Agency (ECHA)

- American National Standards Institute (ANSI)

- Ahlstrom

- Revolution Fibres

- EIT Manufacturing

- Hollingsworth & Vose

- Mitsubishi Chemical Group Corporation

- Council for Scientific and Industrial Research (CSIR)

- DuPont

- Advanced Textiles Association